The company is moving from strength to strength as it builds out its drug development pathway for the lucrative US market.

Pharmaceutical cannabis and psychedelic company Incannex Healthcare (ASX:IHL) is coming off a busy quarter as it executes on its multi-channel drug development pathway.

The company currently has programs underway with the US Food & Drug Administration for six different medicinal cannabinoid pharmaceutical products and psychedelic medicine therapies.

And as its 4C filing for the March quarter highlighted, the IHL management team continues to build strong momentum across the portfolio.

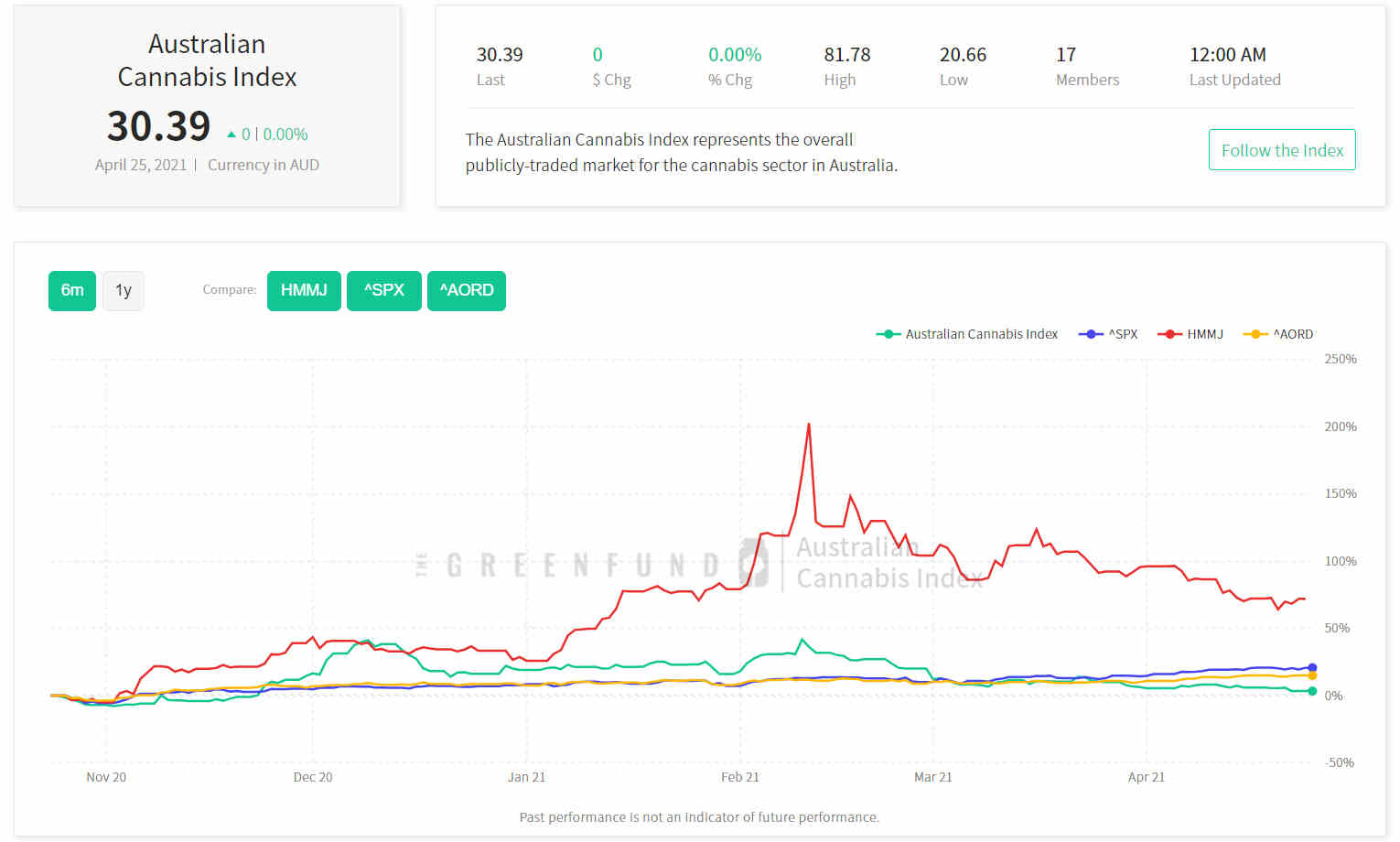

Investors responded to the update, sending IHL shares higher again in morning trade to 30.5c – a doubling of the share price since January.

Clinical pathway

Those gains reflect IHL’s ability to advance each of its treatment options with US health regulators, as it builds towards clinically-backed cannabinoid solutions and positions to be ‘the next GW Pharma’.

Among its key developments in the quarter, IHL highlighted advances in its Phase 2 clinical trial to assess the safety and efficacy of its psilocybin-assisted psychotherapy in the treatment of Generalised Anxiety Disorder.

The trial – a world-first — will be carried out as a randomised double-blind active-placebo-controlled procedure, and follows a partnership agreement with a leading research team at Monash University led by Dr Paul Liknaitzky.

Demonstrating the potential of the sector, two psilocybin research programs for depression have received Breakthrough Designation from the FDA.

IHL has now engaged US-based Camargo Pharmaceuticals LLC to work with Incannex and Monash to compile a pre-Investigational New Drug (‘PIND’) application to put to US health regulators.

Elsewhere, IHL has already completed a successful PIND meeting with the FDA for its IHL-675 treatment – a multi-use pharmaceutical drug which combines cannabidiol (CBD) and hydroxychloroquine.

During the quarter, IHL received multiple sets of positive results from multiple in vivo studies using animal models that demonstrated the application of IHL-675 in the treatment of three distinct conditions:

- Lung inflammation – including acute respiratory distress syndrome (ARDS) and sepsis associated ARDS (SAARDS), COPD, asthma, and bronchitis,

- inflammatory bowel disease, and

- rheumatoid arthritis

IHL is now in the process of developing Phase I in-human clinical trials for the purpose of developing three distinct investigational new drug applications (INDs), with a potential addressable market across the space of more than $US100bn.

In addition, the company also advanced the Phase 2 Clinical Trial for its IHL-42X drug used in the treatment of Obstructive Sleep Apnoea (OSA).

“The primary endpoint under observation is the reduction in Apnoea Hypopnea Index (‘AHI’), compared to baseline, or pre-treatment, levels and the trial is being performed at the Alfred Hospital under the supervision of experienced principal investigator Professor Terry O’Brien,” IHL said.

OSA affects more than 30m people each year in the US alone, and is also classified as an addressable market of more than $US100bn for successful treatment options.

“There is currently no pharmacological product available for its treatment,” IHL said.

“Therefore, the board of directors considers that positive results from the trial will be a major value driver for the company.”

Rounding out its multi-channel product development, the company highlighted an extensive in vivo study being carried out by the Monash University Trauma Group at the Department of Neuroscience, where its IHL-216A treatment is being assessed in a model of traumatic brain injury developed by US NFL.

US listing

With an extensive pipeline of product development channels targeting unmet medical needs in the major US market, IHL also reiterated its potential capacity to seek a listing on US capital markets, which it began investigating in February.

The move was in response to “increasing investor interest in both cannabinoid-based pharmaceuticals and psychedelic therapeutic endeavours in North America”, the company said.

In that context, IHL has commissioned US-based EAS Advisors LLC to facilitate introductions to US banks and institutions “with the intention to list on a US main market, whilst simultaneously retaining its ASX listing”, the company said.

As the company’s operating momentum moves from strength to strength, IHL finished the quarter with $10.4m cash in the bank, and remains well-capitalised to advance its multi-channel development pathway for the lucrative US market.

This article was developed in collaboration with Incannex Healthcare, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Incannex highlights Q1 momentum with 4C update, shares rally again appeared first on Stockhead.