Last week the US government announced it would begin granting growing approvals to several companies for medicinal marijuana research, ending an informal moratorium on licence issuing which has been in place since the Trump administration.

According to a press release from the founder and CEO of Biopharmaceutical Research, George Hodgin, the marijuana manufacturing approvals represent a “monumental step” forward for the American cannabis industry.

“This federal licence will forever change the trajectory of our business and the medicinal cannabis industry,” Biopharmaceutical Research George Hodgin said.

“The DEA’s leadership will set off a nationwide wave of innovative cannabis-derived treatments, unlock valuable intellectual property and create high quality American jobs.”

At the same time, it was also announced that the Minnesota state government had successfully passed a proposal to legalise recreational marijuana use. However, while the legislation’s passage through the House was largely expected, it faces a tougher time in the Republican-controlled Senate, which has historically demonstrated extreme reluctance to entertain the issue.

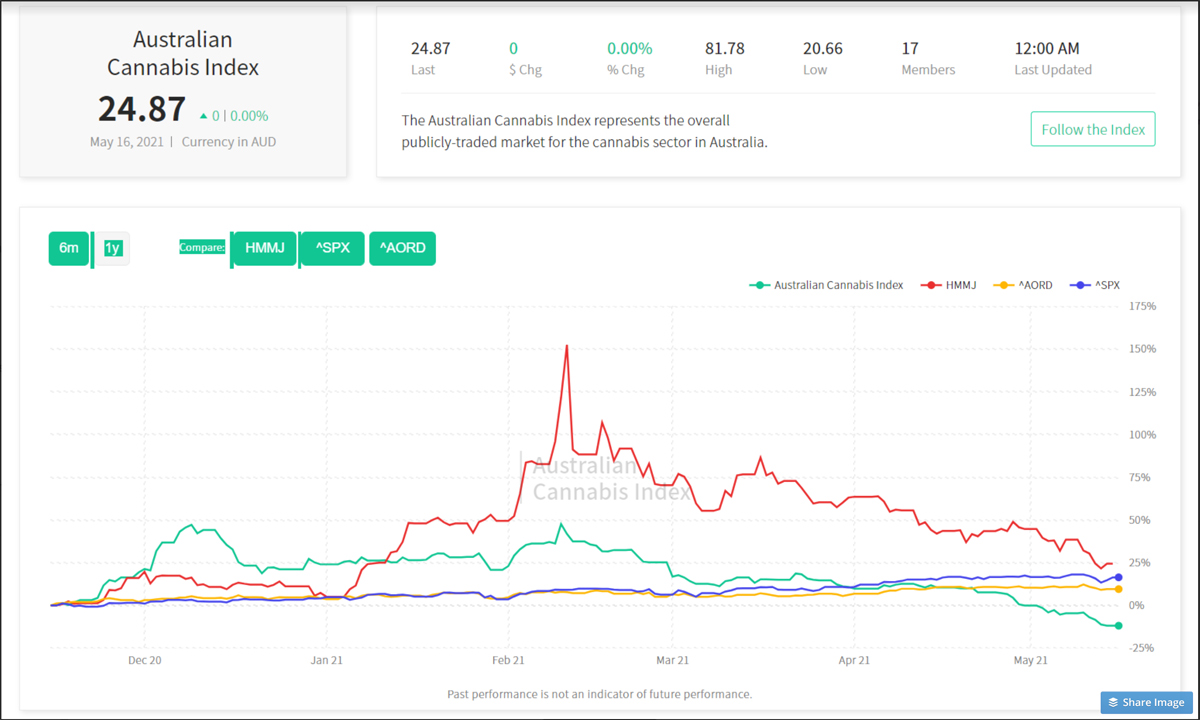

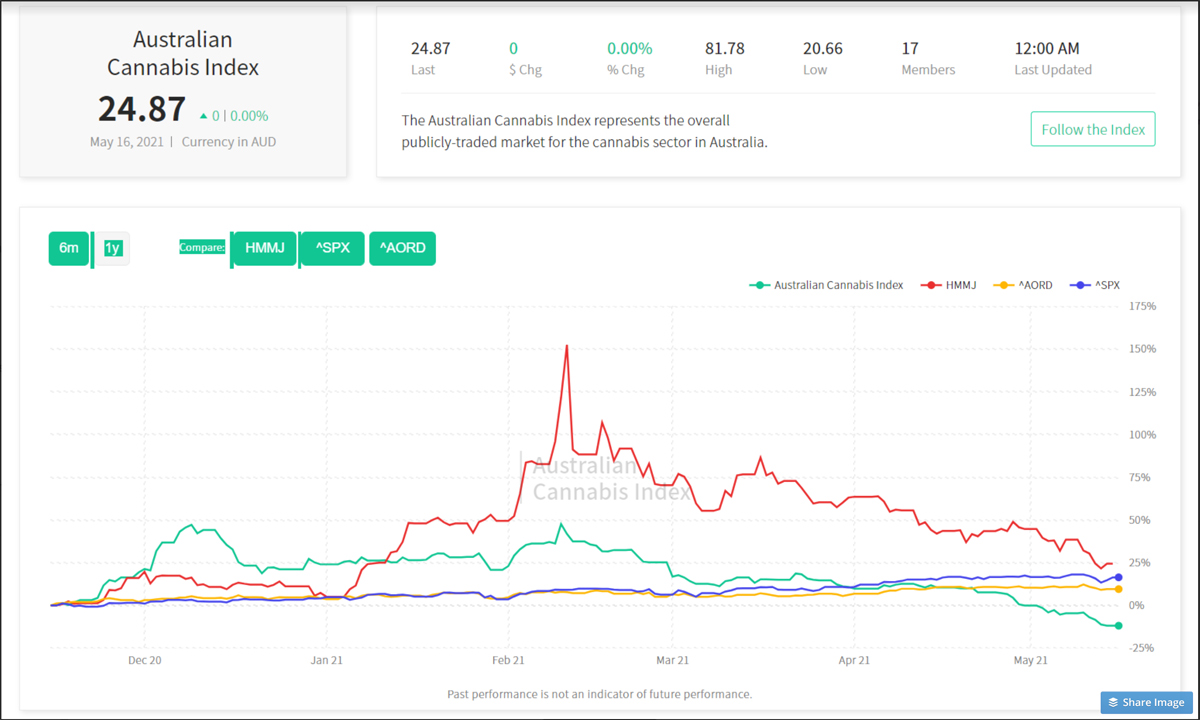

As a result, the outlook of the ‘Horizons Marijuana Life Sciences Index ETF’ (HMMJ) experienced a noticeable spike on the six-month performance chart on Friday—after flagging for much of the week — showing a gain of 24.4%.

Conversely, the performance of the Australian Cannabis Index spent the week in a state of ongoing decline before reaching a nadir of -11.9% by the week’s end, while the S&P 500 and Australia’s All Ordinaries both experienced minor dips followed by moderate rally.

The Australian pharmaceutical developer, Incannex Healthcare (ASX:IHL), announced last week that it had partnered with the University of Western Australia Centre for Sleep Science (UWA) to expand its ongoing investigative IHL-42X clinical trial to a multi-site study.

While the Obstructive Sleep Apnoea trial is currently being conducted at the Alfred Hospital in Melbourne, additional patient recruitment will now also be handled by the medical and scientific staff at UWA.

The move leaves the company well-positioned to pursue the next steps in its clinical development program, as an eventual application for FDA product registration will require multi-site patient examinations.

“We have been impressed with the academic credentials of the team at UWA CSS and their enthusiasm for the potential of IHL-42X as a treatment for OSA,” Incannex Healthcare Managing Director and CEO Joel Latham said.

“UWA CSS are also the only academic institution in Australia that has experience in conducting research on cannabinoids and sleep disorders.”

The Green Fund’s Australian Cannabis Index allows investors to benchmark top players in the Aussie cannabis space against the S&P500, the AORD, and HMMJ, giving them an overview of the health of the industry Down Under.

The post US growing approvals a ‘monumental’ step away from Trump moratorium on pot licensing appeared first on Stockhead.